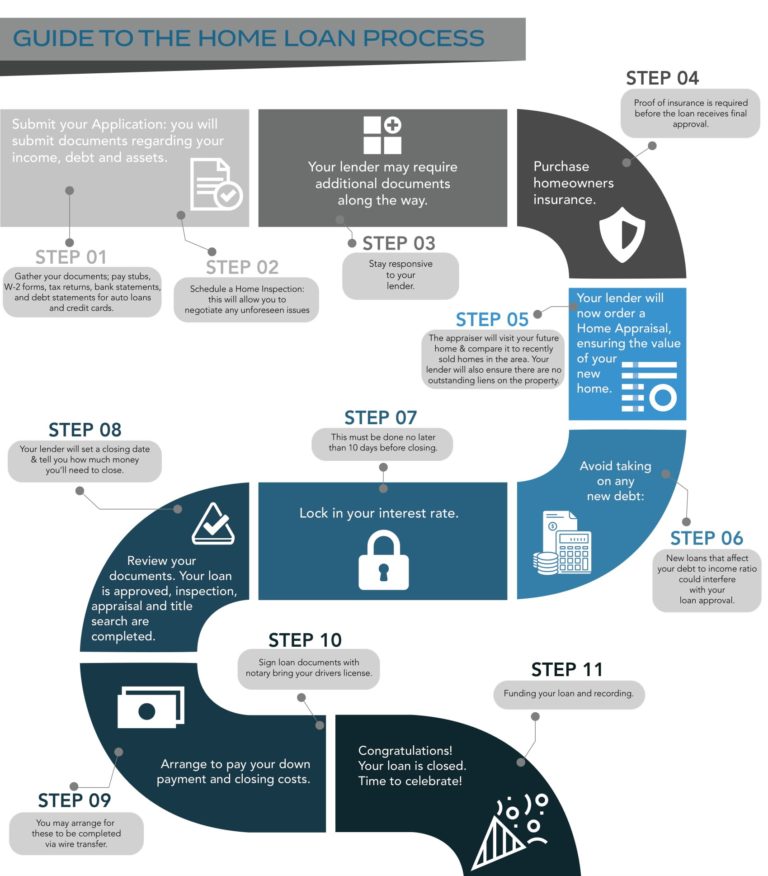

GUIDE TO THE HOME LOAN PROCESS

Applying for a home loan is easy as Cristal Cellar offers a streamlined application process for financing your new home. Check out Cristal Clear’s 11-step process Home Loan Road Map:

WHO ARE WE?

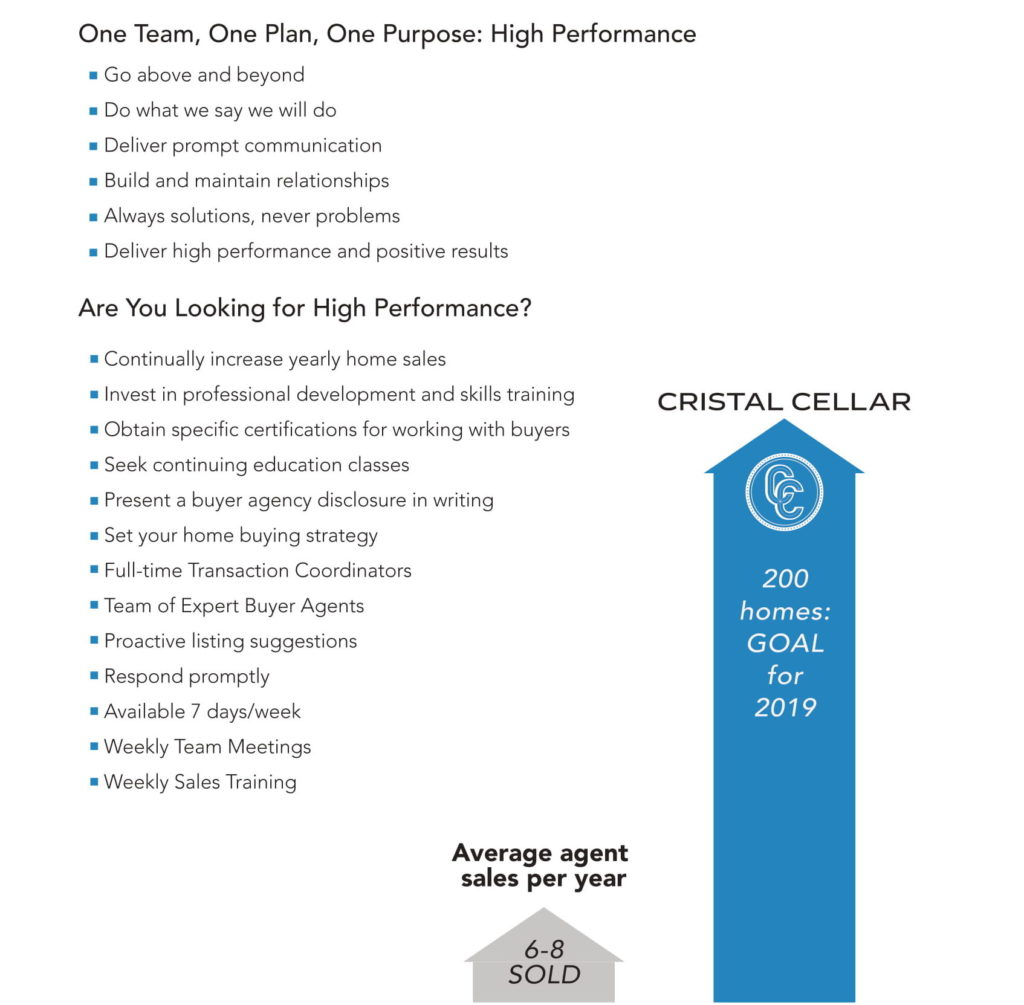

Cristal Cellar was built on the notion that the secret to achieving incredible goals and getting true results is to dominate real estate with a team approach. One part-time agent does not have the capacity to cover every aspect of the real estate process.

We operate in a supportive, professional, positive environment that helps each member of our team provide the highest level of service in the industry. This atmosphere allows our team to act on the passion and drive it takes to surpass the expectations of every client who chooses us to help fulfill their home buying or selling goals.

“...surpass the expectations of every client who chooses us...”

Whether you are looking to sell your property or buy a new home, Cristal Cellar offers a dedicated, skilled team with an innovative marketing approach.

Our team of experienced, full-time real estate agents and staff are ready to lead and advise you through the process of buying the perfect home or selling your existing home for the most amount of money in the shortest amount of time.

Vision Statement

Our vision is to grow our company by quality, not quantity, and to revolutionize the industry through creative synergy and become the premier standard for a holistic approach in the residential real estate market.

Core Values

- Loyalty

- Creativity

- Grit

Value Proposition

Our greatest value for clients is to empower them through knowledge by combining the mortgage process seamlessly with the sale or purchase of the residential real estate.

Mission Statement

The mission of Cristal Cellar is to be the first choice in the real estate and mortgage industry by building long lasting relationships.

GUIDE TO THE HOME LOAN PROCESS

Application

Submit your application and documents regarding your income, debt, and assets.

1. Gather your documents, pay stubs, W-2Forms, tax returns, bank statements, and debt statements for auto loans and credit cards.

2. Schedule a Home Inspection: this will allow you to negotiate any unforeseen issues.

3. Stay responsive to your lender as he may require additional documents along the way.

Insurance

4. Proof of homeowners insurance is required before the loan receives final approval.

Home Appraisal

Your lender will order a Home Appraisal to ensure the value of your new home.

5. A property appraiser will visit your future home & compare it to recently sold homes in the area. Your lender will also ensure there are no outstanding liens on the property.

Debt

6. Avoid taking new debt as new loans that affect your debt to income ratio could interfere with your loan approval.

Interest Rate

7. Lock in your interest rate no later than 10 days before closing.

Review

8. Once your loan is approved, inspection, appraisal, and title search are completed, your lender inform you of the closing date and the amount needed.

Down Payment

9. Arrange to pay your down payment and closing costs. You may do so through wire transfer.

10. Sign loan documents with a notary and bring your driver’s license.

LOAN TERM DICTIONARY

Refinance

Means to finance something again, typically with a new loan with a lower interest rate. Refinancing is done to allow a borrower to obtain a better interest rate. The first loan is paid off, and a second one is created.

Cash Out Refinance

A refinance is made in order to pull equity out of your current home loan. The difference of what is pulled out will be added to the new loan.

PMI

“Private Mortgage Insurance” is usually required when you have a conventional or FHA loan. It is a separate payment made to an insurance company in case a borrower defaults on a loan.

DTI

“Debt to Income Ratio” has two types: front and back. The front-end DTI ratio is usually calculated as housing expenses, such as a mortgage, mortgage insurance, etc., divided by gross income. Back End DTI Ratio calculates the gross income percentage for things like credit card debt and car loans.

PITI

Principle, Interest, Taxes, and Insurance.

ARM

“Adjustable Rate Mortgage” rate of the loan will adjust over a consistent period of time-based on the market.

Fixed Rate

Rate is fixed for the life of the loan.

HUD REO

Bank-owned property. A property that has failed to sell at a forclosure auction.

PRE-APPROVAL

Getting pre-approved for home financing provides several major advantages, especially in competitive markets. When you work with Cristal Cellar, you can obtain a fast and accurate pre-approval, even with a TBD property address.

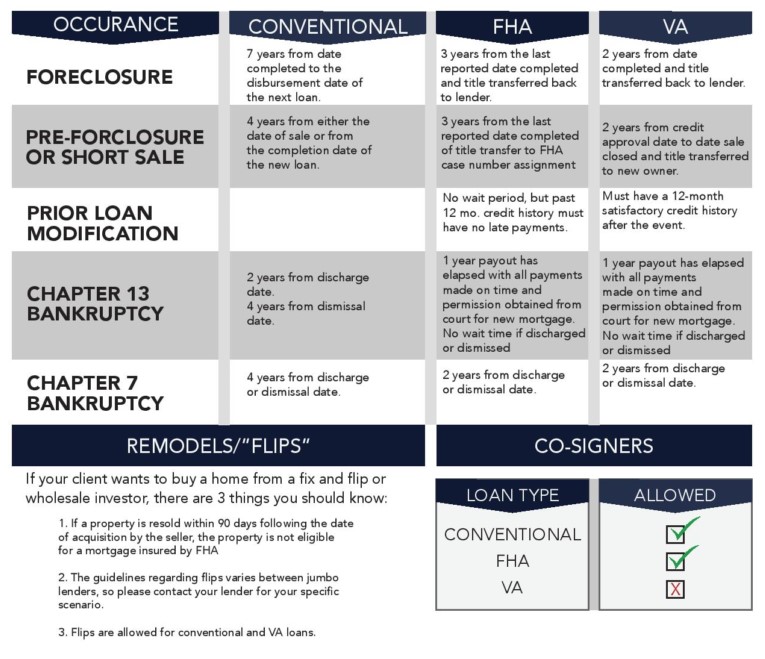

WAIT TIMES

If you have a past history of any of the following financial mishaps, certain waiting periods may apply before you can become approved for a home loan.

How can a TBD approval help you?

- In a competitive market with multiple buyers, sellers often choose the pre-approved buyer – even if their offer is slightly lower than other potential buyers without pre-approval.

- If you have unconfirmed credit and/or employment history, a pre-approval can help you find out if you qualify.

HOW MUCH DO I NEED FOR A DOWNPAYMENT?

How much do you need for closing costs?

Home buyers typically pay between 2 and 5% of the purchase price in closing cost fees.

Upfront mortgage insurance is 1.75% of the loan amount

Monthly mortgage insurance is paid monthly, which is included in your monthly payment.

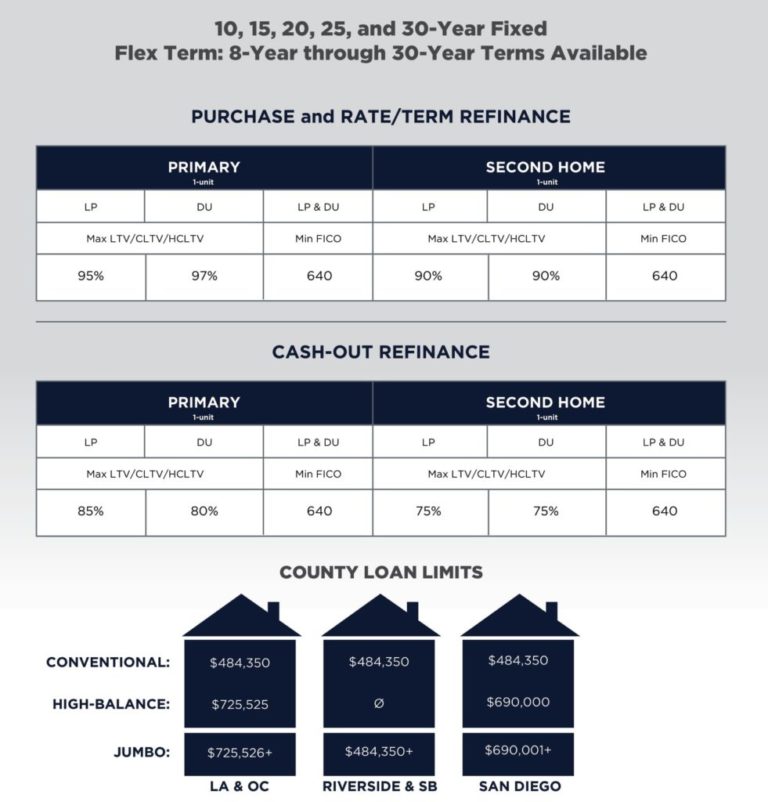

CONVENTIONAL LOAN LIMITS

FHA LOAN LIMITS

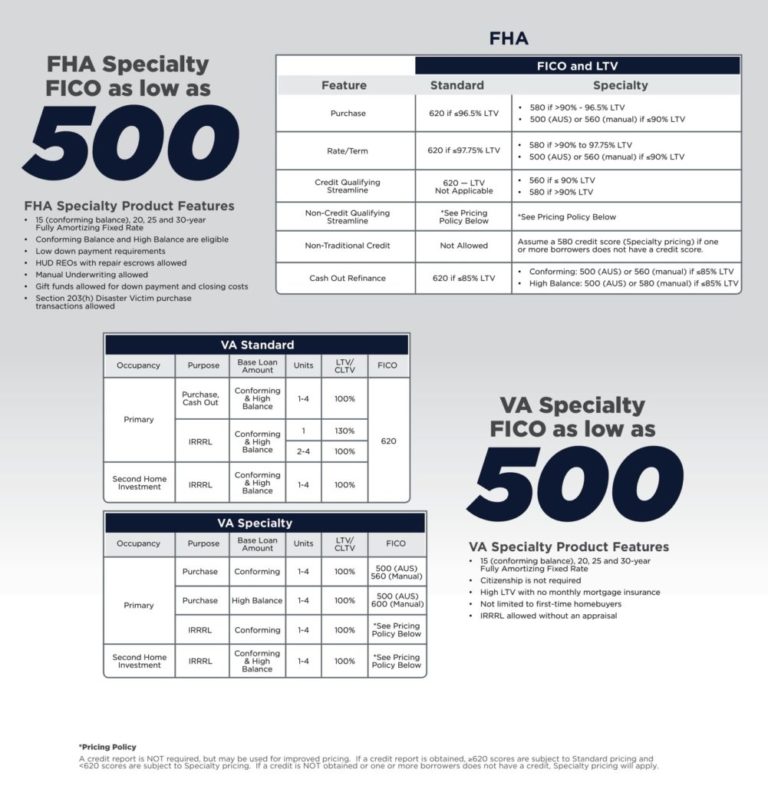

FHA & VA

CONVENTIONAL

OUR PROGRAMS

FRESH START

Over the past few years, many hard-working people who lost their homes or were forced into bankruptcy due to a layoff or reduced income have since rebuilt their credit and are able to demonstrate their ability to repay. For these borrowers who may be unable to obtain mortgage financing due to seasoning or other requirements, Fresh Start may be the lending solution they have been looking for.

Loan Features

- LTV up to 80% with no MI

- No seasoning requirement on derogatory housing events, including Bankruptcy, Foreclosure, Deed-in-Lieu, Mortgage, Charge-off, or Short Sale

- No mortgage or rental pay history required

- Minimum credit score 580

- Loan amounts from $100,000 to $1,000,000

- Non-warrantable condominiums

- Purchase, rate/term, cash-out including Texas 50 (a)(6) and debt consolidation

- 100% gift funds allowed from family members

- Up to $350,000 max cash back on cash-out refinance transactions

- ARM and 30 Year Fixed options available

- No pre-payment penalties Owner occupied & Second Homes available

- Non-traditional credit allowed

Call today for more info on Fresh Start and all of our home loan products!

JUMBO

Our new flexible program will open your options if you’re looking to purchase a home in a high cost area or refinancing your existing jumbo loan.

Key highlights to the program include:

- Maximum Loan Amounts up to $2.5 million

- Minimum 720 FICO

- Maximum Loan to Value ratios up to 80%, Maximum 43% DTI ratio

- Maximum Loan Amounts up to $2 million

- Minimum 700 FICO

- Maximum Loan to Value ratios up to 80%, Maximum 43% DTI ratio

- Maximum Loan Amounts up to $1.5 million

- Minimum 680 FICO

- Maximum Loan to Value ratios up to 80%

- Maximum Loan Amounts up to $1.0 million

- Minimum 740 FICO

- Maximum Loan to Value ratios up to 90%, Maximum 38% DTI ratio

- Maximum Cash Out amount permitted up to $500,000

- Fixed and ARM options that include 7/1, 7/4 and 10/1, and investment properties.

- 1-4 Unit Primary Residence, 1 Unit Second Homes

- Only one appraisal required, up to $1,500,000 loan amount

FUTURE OUTLOOK

SERVICES

Real Estate

- Listing and marketing properties to obtain the highest and best offer for sellers.

- Research, locate properties, and negotiate terms on behalf of the Buyer.

- Provide clients real estate opportunities with an ROI against inflation.

- Preserve the value of the property while generating income by securing Tenants, negotiating lease contracts, collecting rent, and maintaining the property

- Negotiate on behalf of the seller with the lender for a Short Sale Approval in addition to marketing the home to obtain the highest and best offer for the seller.

- Negotiate on behalf of Buyer with the lender for best terms for Buyer.

- Facilitate in locating lease properties for prospective Tenants in addition to locating qualified Tenants for landlords.

Mortgage

- A government-backed loan program allows clients to obtain a loan with a lower down payment.

- A loan designed only for military veterans to allow them to obtain home financing with the option of no down payment.

- Provide clients with Traditional 30, 20, 15, 10 year fixed rate loans.

- Allows people with FHA loans to refinance at a lower rate with less paperwork and simplified requirements.

- Refinance for a lower payment without having to pay for closing costs.

- Tap into your home equity and use it as a form of retirement income.

- Pull cash out from the equity in the home.

- Investment loans for investors or unconventional loan programs for clients who do not qualify for conventional loans or government-backed loans.

OUR RECORD

Real Estate

Total Sales Over Past 3 years

$77,227,155

2016

Total Gross Sales: $14,829,955

2017

Total Gross Sales: $28,202,716

2018

Total Gross Sales: $34,194,48

2019

Total Gross Sales: $47,757,339

Mortgage

Total Loans Funded Over Past 3 years

$77,227,155

2016

Total Loan Amount Funded: $8,916,395

2017

Total Loan Amount Funded: $24,849,284

2018

Total Loan Amount Funded: $12,993,972019

2019

Total Loan Amount Funded: $27,926,595

THIRD PARTY REFERENCES

Chris Barredo – State Farm Insurance Agent

State Farm Chris Barredo

chris.barredo.u50s@statefarm.com

714.739.2460

Stephen Ensberg – Attorney at Law

Law Offices of Stephen E. Ensberg

sensberg@aol.com

626.813.3744

Pratik Shah – Attorney at Law

Shah Law PC

shah@shahlawpc.com

213.761.5529

Justin Tarroza – Tax Preparer

JJT Firm, LLC

justin@jjtfirm.com

818.635.1080